On March 14th 2008, this blog talked about how

It is being whispered that Barran Wolfet and his team members, Sorg Goros and Rim Joggers had played a major role in the enhancement of these gold stocks - and the formation of IMAR. Initially named as Global Financial Reserve Authority for Development, the IMAR idea was first tossed out over a dinner at the famous Les Ambassadeurs eatery - which offers a classic cuisine by the Ducasse-trained chef, Jean-François Piege.

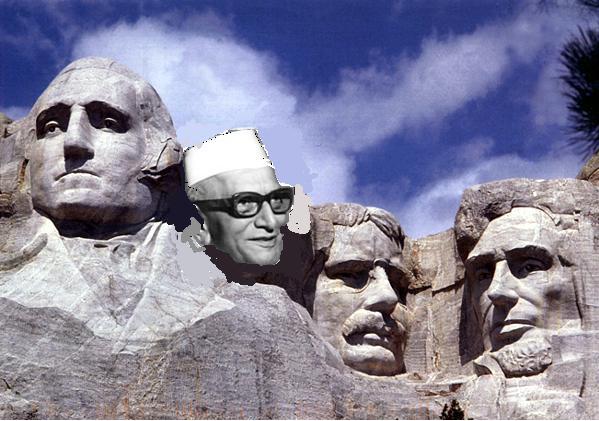

The US Electoral outcome

There is (seemingly) harmless speculation that next US President may appoint Warren Buffett as the Treasury chief

The two were asked at the beginning of their second presidential debate who would be a good replacement for current Treasury Secretary Henry Paulson who is standing down at the end of the current administration.

“I think the first criteria, would have to be somebody who immediately Americans identify with. Immediately say we can trust that individual,” said McCain. Buffett, chief of the Berkshire Hathaway holding company, has supported Obama in the race for the White House.

Barack Obama’s chance of a lifetime

If Barack Obama wins on 4 November, as looks likely, he’ll inherit an economic mess rivalled only by the one that faced Franklin Roosevelt in 1933.

Everyone is saying …

There is rising chorus that the new President (whoever it may be) should do what Roosevelt did. What they are not saying, but meaning is, do what Roosevelt did. Krugman, this year’s Nobel prize winners, also said in an interview that Roosevelt’s actions need to be emulated.

Apart from the many things that Roosevelt did, the merits of which are debatable, the one thing that he did made the US into a super power (what if it was for a short while of 70 years).

Roosevelt nationalized gold.

Nationalization of gold enabled the US Governments to enter costly wars like WW2, Vietnam War, and now the Iraq and Afghan Wars. This allowed to US to walk into the WW2 with 25,000 tons of gold - and impose Bretton Woods on the world. And the nationalization of gold also impoverished the Americans - apart from the poor.

Gold production (from Ghana, South Africa, Australia, Canada, Papua New Guinea, America, etc.,) was controlled by the Anglo Saxon Bloc - and the world’s largest private reserves of gold, in India were controlled by the British. It is this choke on gold reserves that enabled thes sustenance of US as a superpower.

And now they are trying it again.

The methodology

And how do the US 'thought leaders' suggest that new President do it ... when victory is within grasp, and Obama Faces A New Choice

The opposite argument is that the political costs of voicing pessimism are prohibitive, that there is plenty of opportunity to prepare voters for drastic action after election day, and that a candidate risks worsening conditions by sounding strong warnings. The classic example to support this case is the 1932 Depression-era campaign of Franklin Delano Roosevelt, who said little or nothing while campaigning in 1932 to indicate the contours of his New Deal program.

What are they pulling over our eyes…

This again very interesting. Roosevelt’s economic plan was surprise. Obama (or McCain, doesn't matter who), will do something similar. Read this with the Warren Buffet silver play and his (possible) appointment as Treasury Chief, and the game becomes clear.

Nationalize gold again?

But What Was Warren Buffet Doing ...

Buffett’s Purchases Push Silver Past $7 an Ounce said the New York Times

Separately yesterday, Phibro, a commodities-trading firm, confirmed that it was the dealer for all the silver purchases by Berkshire. Phibro is a unit of the Travelers Group, in which Berkshire has a major stake. Last week, a Canadian investor filed suit in United States District in New York, contending that Phibro had moved silver from warehouses in the United States to hidden locations in an effort to mislead traders about supplies and push the price higher. A Phibro official denied all the charges yesterday.

How did Warren Buffet buy such a large amount of silver without disturbing the market?

The silver purchases by Berkshire Hathaway were made in London, a center of activity in the silver market. The purchases were done with over-the-counter contracts, in which Mr. Buffett bought silver for delivery at future dates. Since he began he has accepted delivery of 87.51 million ounces, which are apparently now sitting in the vaults of London bullion banks. The remaining 42.2 million ounces must be delivered between now and March 6.

60 days from now … Warren Buffet Handle The US Treasury?

Sometime, back there was speculation that Warren Buffet could be a possible choice of US Treasury Chief. This news was sparsely reported - originating with AFP. Google Search showed this up only with a few Indian sites and journals.

What does this mean as possible policy outcome? Do a Quicktake - and then a 2ndlook.

Ben Bernanke says a 'savings glut is the problem ...

Ben Bernanke joins a long list of Western propagandists, who find 'specious' ways to blame others for Western problems. His most recent propaganda gem was to blame Asia for a 'savings glut.'

a satisfying explanation of the recent upward climb of the U.S. current account deficit requires a global perspective that more fully takes into account events outside the United States. To be more specific, I will argue that over the past decade a combination of diverse forces has created a significant increase in the global supply of saving--a global saving glut--which helps to explain both the increase in the U.S. current account deficit and the relatively low level of long-term real interest rates in the world today.

After Ben Bernanke opened the flood gates of such logic with 'helicopter drop of dollars' and 'printing press technology', and now the 'savings glut' - others such 'economists' have rushed in to do another tom-tom dance around this logic.

A so called economist, weighed in with two bits, Dani Rodrik: Who killed Wall Street?

…the true culprits lie halfway around the world. High-saving Asian households and dollar-hoarding foreign central banks produced a global savings “glut,” which pushed real interest rates into negative territory, in turn stoking the US housing bubble while sending financiers on ever-riskier ventures with borrowed money. Macroeconomic policymakers could have gotten their act together and acted in time to unwind those large and unsustainable current-account imbalances. Then there would not have been so much liquidity sloshing around waiting for an accident to happen.

The Real Culprits …

Ben Bernanke is not even mentioned even once. Bernanke’s printing press and helicopter’s are not mentioned even once. The evasion of Federal Reserve on M3 figures are not mentioned even once. Alan Greenspan is mentioned once. China which has funded the US to the extenet of US$2 trillion is not even mentioned once. Japan which has funded the US to the extent of US$1 trillion is ignored.

I rest my case

But Asians countries whose reserves are getting wiped due to dollar depreciation - are instead mentioned as culprits.

Wow. This is a new level in brazen-ness. Keep it up Dani boy.

This fraud may yet happen. And Warren Buffet may give cover to this fraud.